Is Coinbase a buy in 2024? The answer depends on Bitcoin

As the custodian for Bitcoin ETFs, Coinbase's fortunes wax and wane with Bitcoin's volatile market, presenting a high-risk, high-reward scenario for investors.

Coinbase fate is tied to Bitcoin.

If Bitcoin performs well and there are big inflows for the spot Bitcoin ETFs then Coinbase wins on all fronts:

- More fees coming from more trading volume in a bull market.

- More fees coming from the Bitcoins stored with Coinbase Custody.

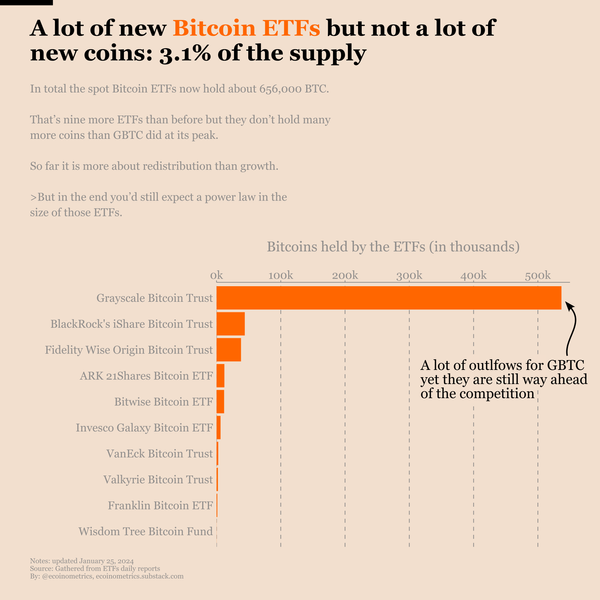

Indeed Coinbase has been chosen by at least nine Bitcoin ETF applicants to be the custodian of the coins held by the ETFs. Based on the data from Q3 2023 Coinbase is keeping 0.014% per quarter of the US$ value in custody.

So that's not huge but that's still potentially tens of millions of dollar per year. And I assume they are getting great margins on that revenue as it does not cost much more to custody $10 billion worth of assets vs $100 billion or $500 billion.

Bitcoin isn't physical gold after all. The logistic of keeping it safe is much more scalable.

Now that's for the bull case. But there is also a bear case.

Coinbase stock price is very strongly tied to Bitcoin's price action. That's for the better but also for the worse.

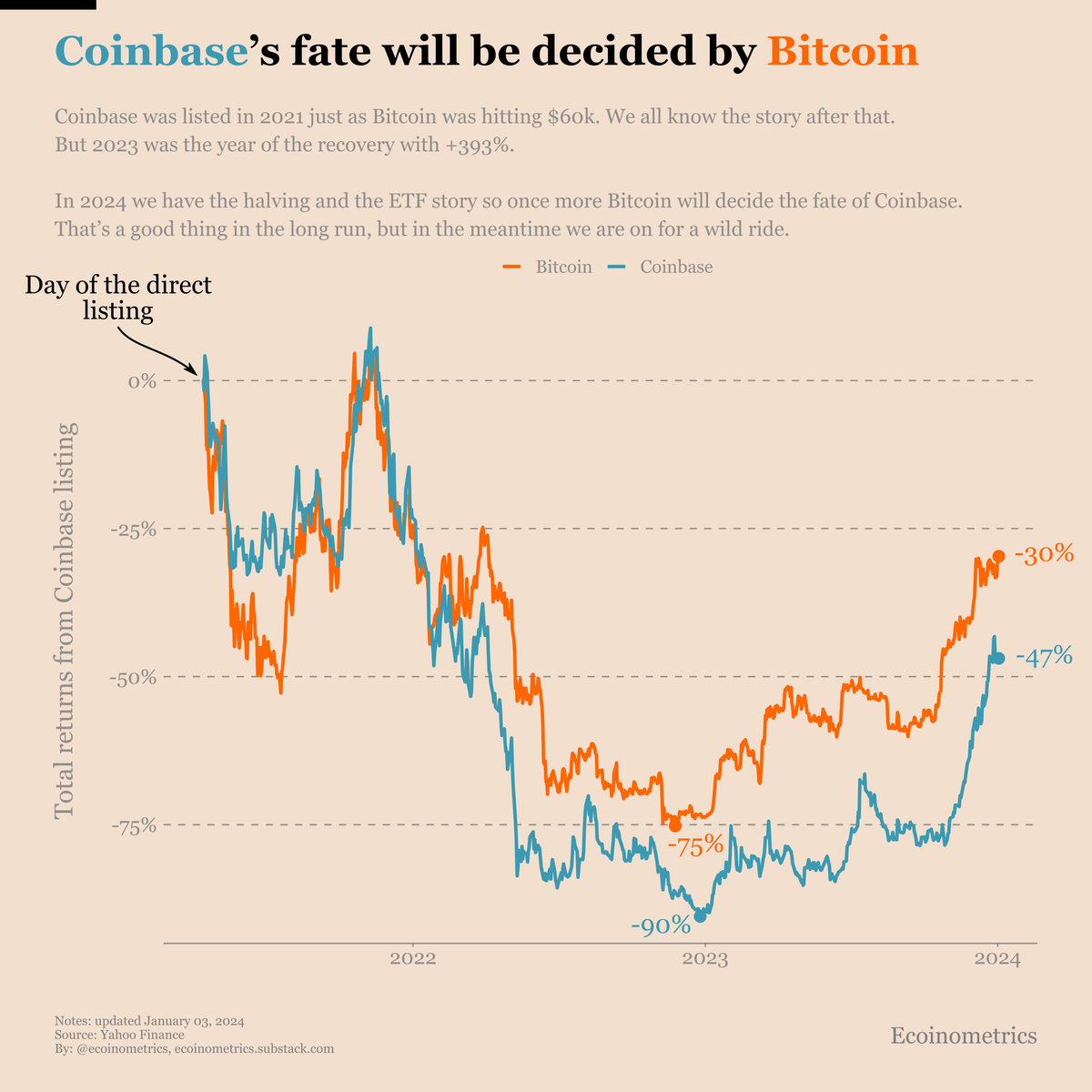

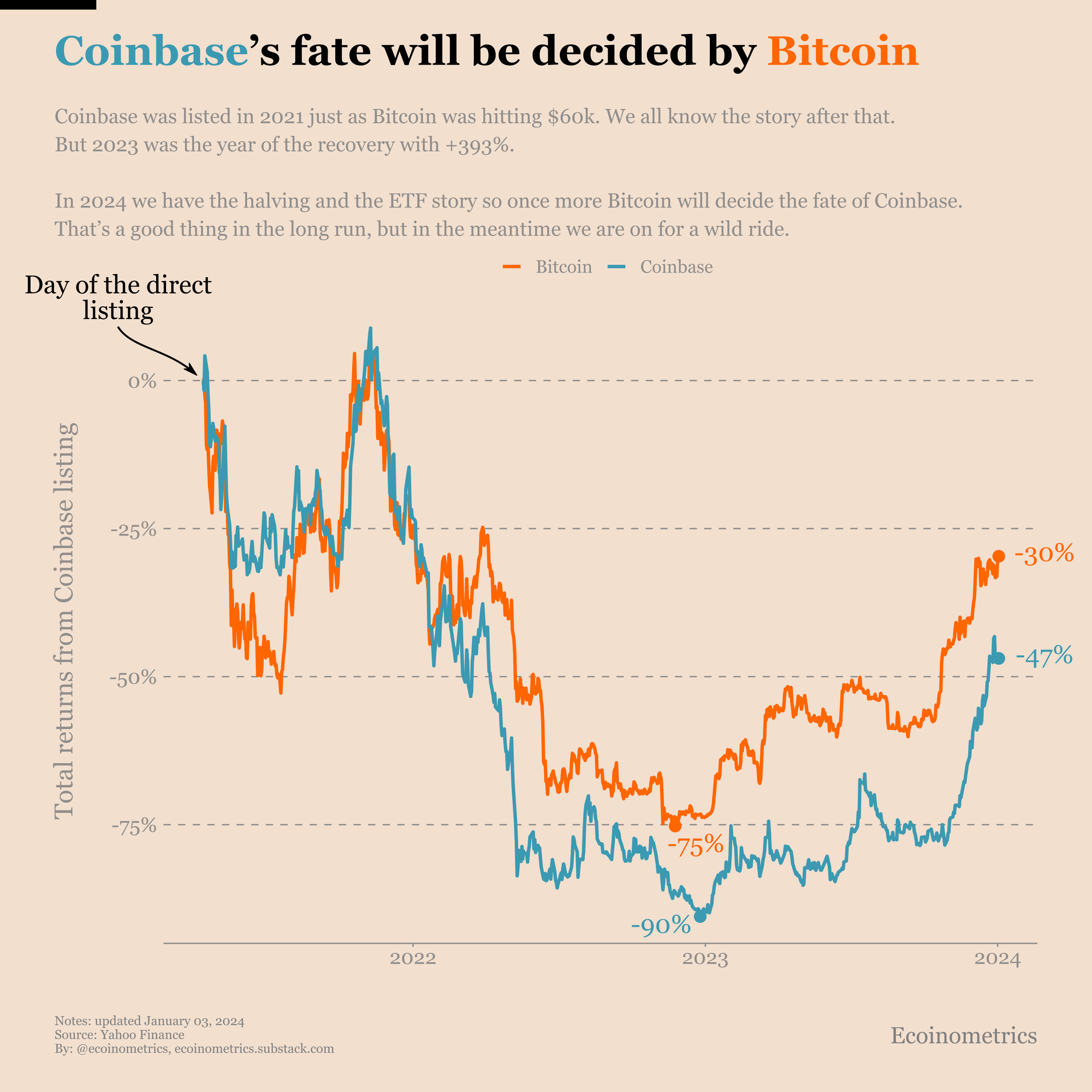

Check out this chart of the total returns of Coinbase and BTC from the day of the direct listing in 2021.

Take the example of the direct listing of COIN. It would have been very hard to pick a worst timing than they did.

The day of the direct listing Bitcoin was touching the $60,000 level. And that was the beginning of the end for the bull market of 2020/2021.

After that Bitcoin dropped -75% and Coinbase followed to -90%.

If for any reason Bitcoin performs badly in 2024 you can bet that Coinbase will follow. But at least there is more hope for the upside potential than ever before in 2024.

P.S. We our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick