How many Bitcoins are captured by the ETFs: after two weeks, not many more than before

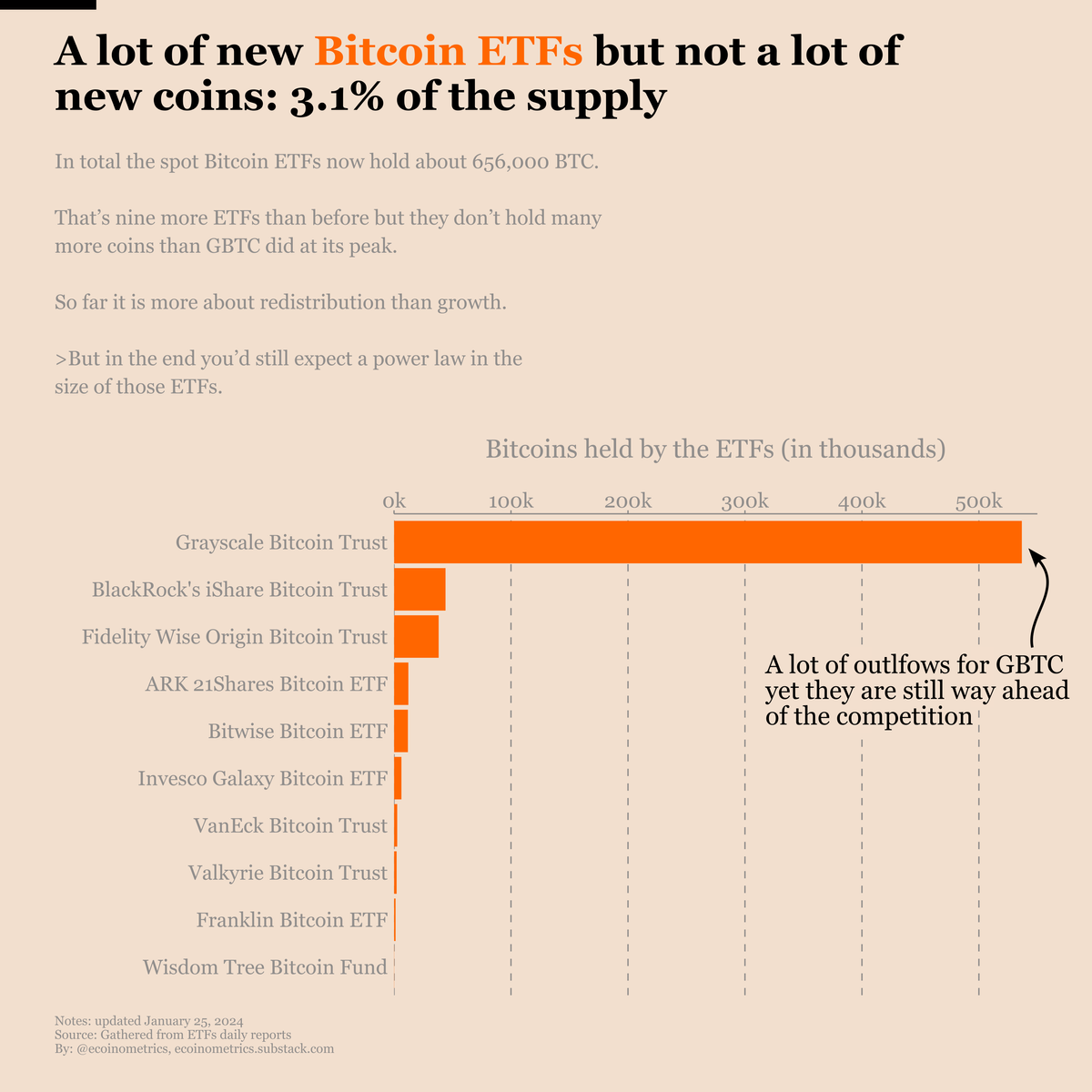

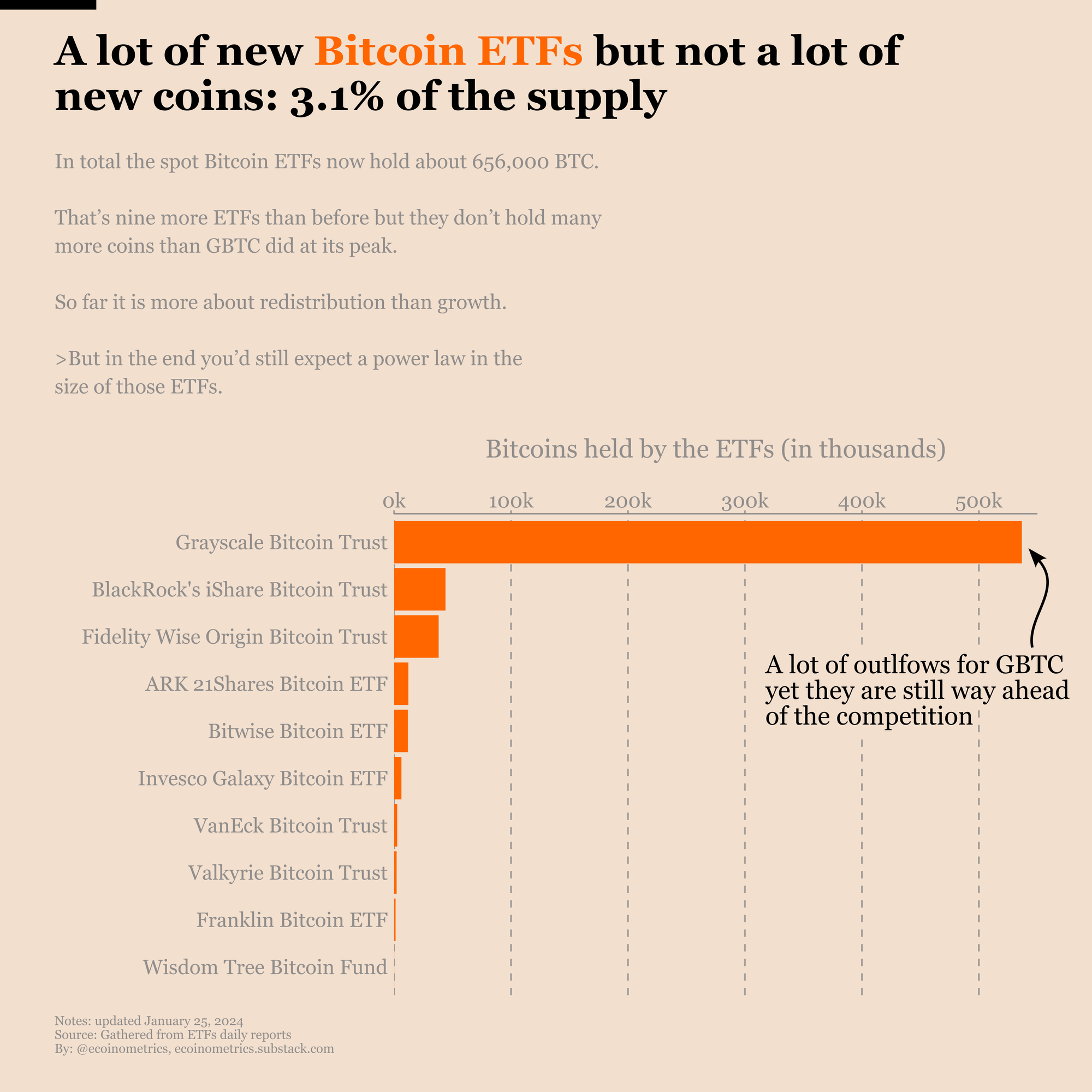

In just two weeks after their launch, new Bitcoin ETFs in the US are collectively holding approximately 656,000 BTC, signalling a significant shift in accessibility for average investors looking to diversify into digital currencies.

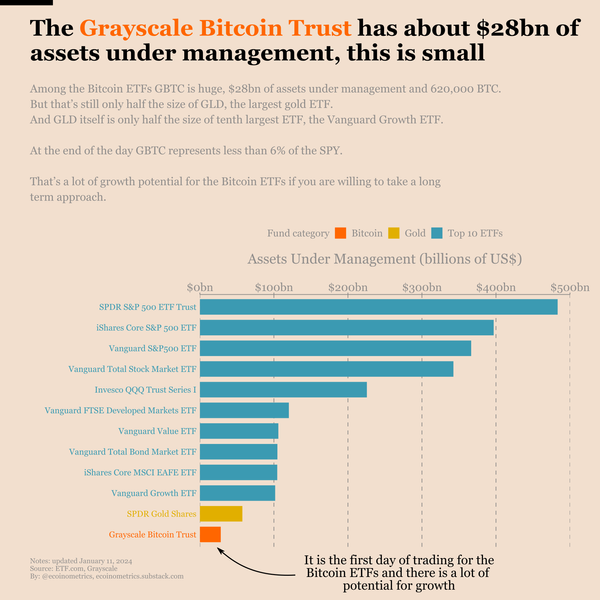

On January 12, 2024 we went from having no real Bitcoin ETF to having ten of them in the US. Granted that the largest one of them, the Grayscale Bitcoin Trust (GBTC), has existed for a long time with a different structure. But still that’s a step change.

Now those products are spot Bitcoin ETFS. That means they are backed by actual Bitcoins held by the ETFs operators. Every time money flows in those ETFs, they turn around and use this cash to buy coins.

So the question is, how many coins are those Bitcoin ETFs holding two weeks after the launch.

The answer is approximately 656,000 BTC. That’s about 3.1% of the total supply of Bitcoins.

But in its previous form the Grayscale Bitcoin Trust was already holding about 635,000 BTC at its peak… so the net effect of these new ETFs is small. And actually GBTC alone still accounts for 2.4% of the total supply of Bitcoins held by ETFs.

All that isn’t very surprising. The ETFs are unlocking access to Bitcoin for a whole new category of investors. The average investor just puts his savings in some ETF tracking the SP500 every month. Now they can allocate a small fraction of those savings to Bitcoin without frictions.

If we see this trend pick up it will put a lot of pressure on the liquid supply of Bitcoins. That’s good for the price.

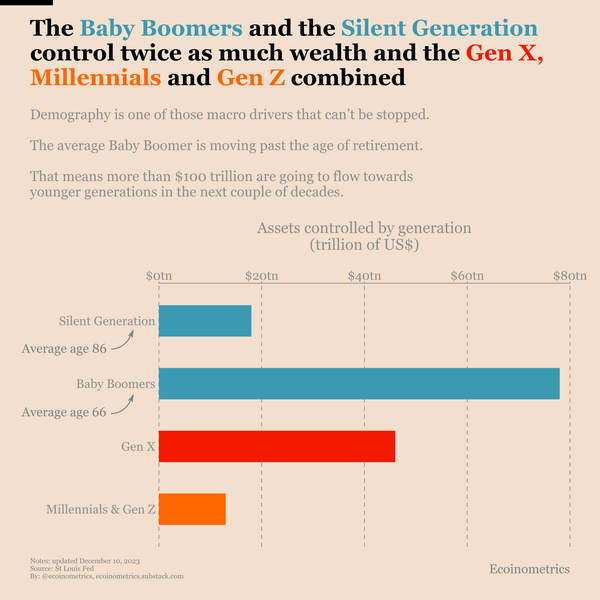

This is the real unlock for the hundred trillion dollars demographic wave that will hit Bitcoin. But it will take time, years not days.

P.S. We spend our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick