Bitcoin's Hundred Trillion Dollars Wave: Pay Attention to Demographics

Explore how the impending $100 trillion generational wealth transfer could massively boost Bitcoin's value, and how Bitcoin ETFs are simplifying crypto investments for a new era.

At the beginning of 2024, Bitcoin has a market capitalization of $840 billion dollar. The entire crypto market has a market cap of about $1.7 trillion.

What if I told you this market could grow 100x over the next decade? What if I told you that this growth is due to something unavoidable? What if I just stopped asking what if and told you what this really is about?

One word, it is about one word, demography.

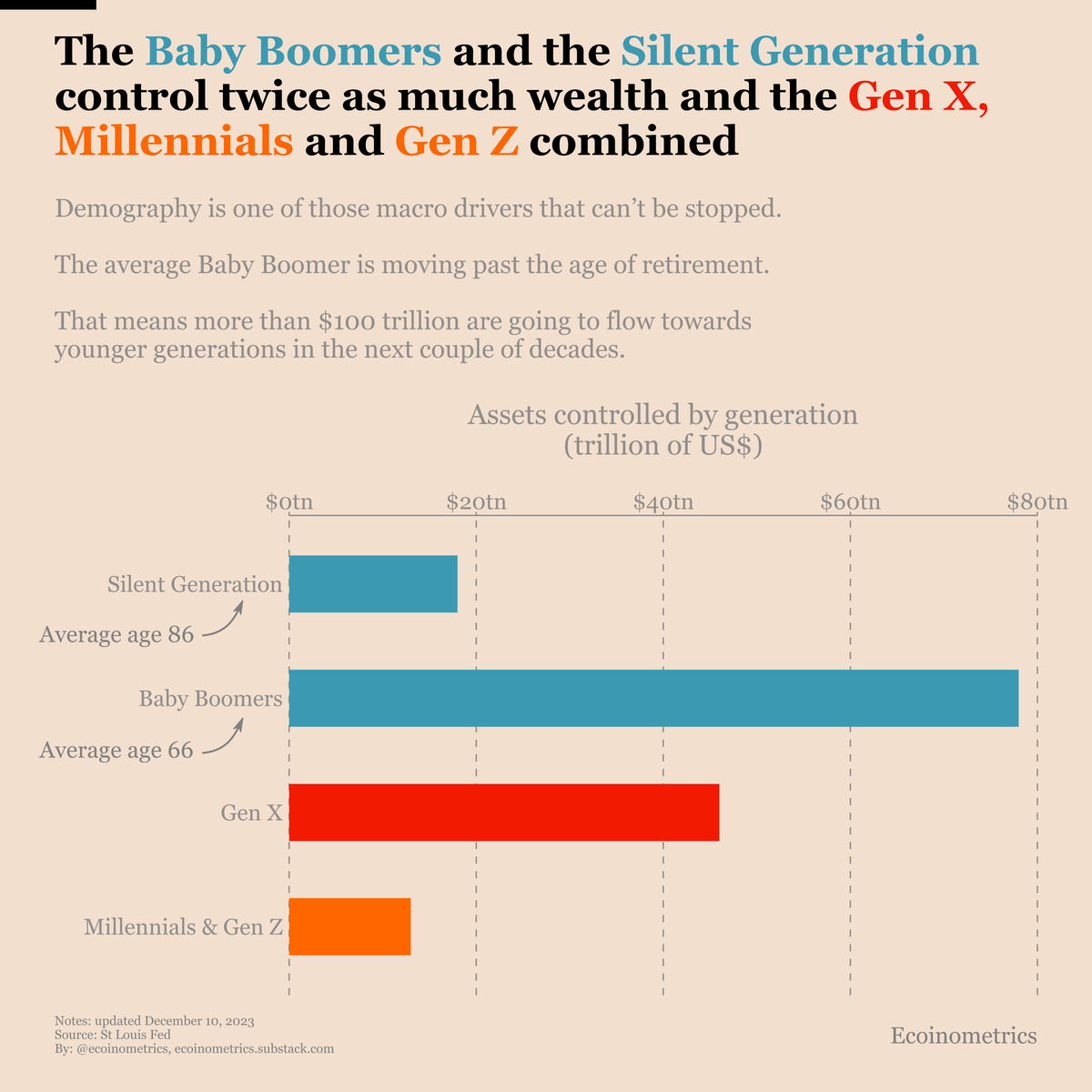

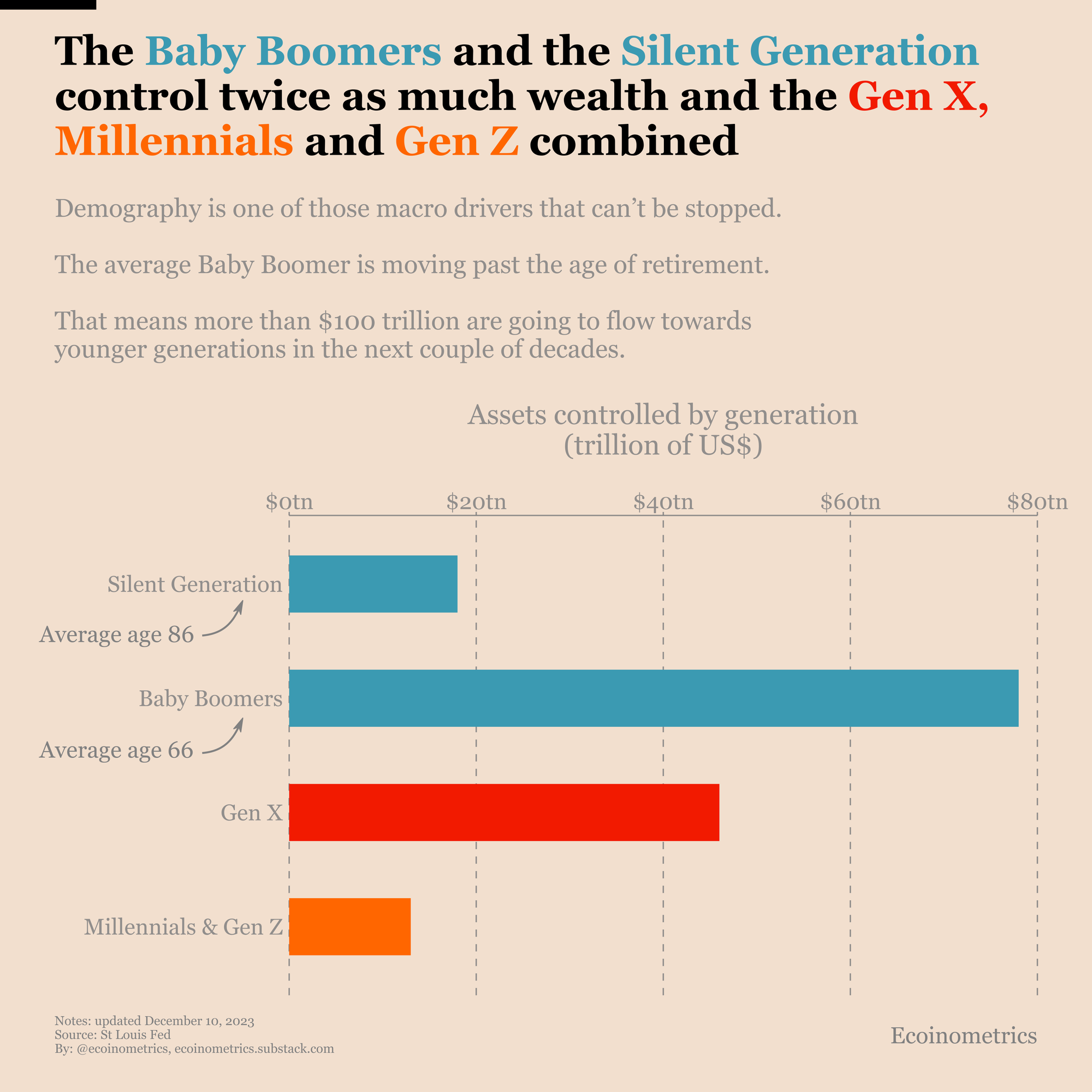

How is wealth distributed in the United States?

The most recent data from the Federal Reserve shows that in the US, wealth across generations is distributed as follows:

- Silent Generation (average age 86), 18 trillion dollars.

- Baby Boomers (average age 66), 78 trillion dollars.

- Gen X (average age 49), 46 trillion dollars.

- Millennials and Gen Z (average age 33), 13 trillion dollars.

As the Silent Generation and Baby Boomers are aging their wealth is slowly moving towards Gen X, the Millennials and Gen Z.

Over the next 10 to 20 years that's a total of $100 trillion which is going to flow towards the younger generation. And their preference of today will impact how they are going to invest this wealth tomorrow.

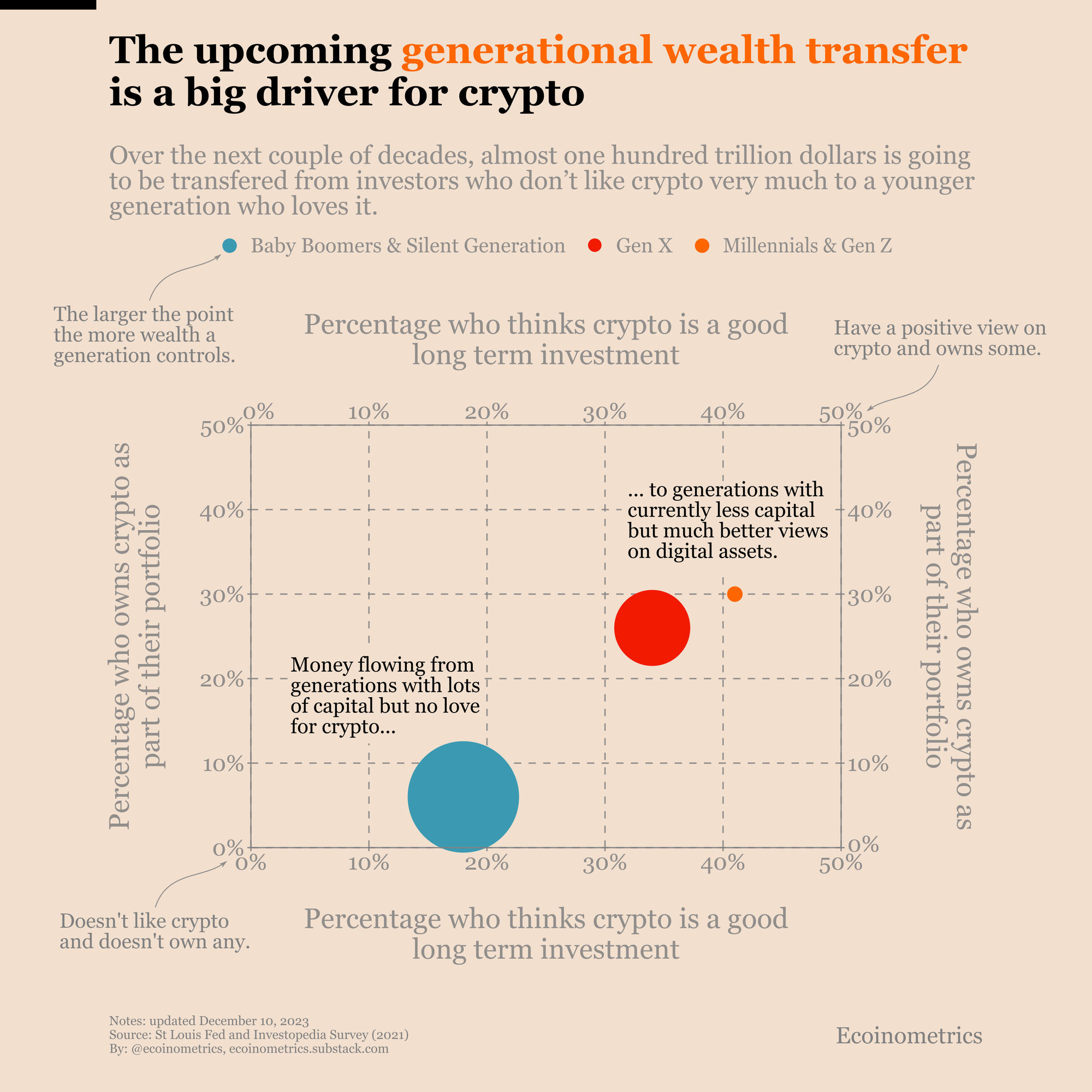

Younger generations love crypto

As of 2021 a survey commissioned by Investopedia concluded that:

- Baby Boomers think crypto is a good long term investment at 18%.

- Gen Xers think crypto is a good investment at 34%.

- Millennials and Gen Z think crypto is a good investment at 41%.

We don't know about the Silent Generation but more likely than not they fall in the same category as the Baby Boomers.

At the same time:

- Only 6% of Baby Boomers hold positions in digital assets.

- While 26% of Gen Xers do.

- And 30% of Millennials + Gen Z do.

What that means is Millennials, Gen Z and Gen X are likely to take advantage of this generational transfer to sell old assets and invest in crypto.

Money flows from baby boomers to Bitcoiners

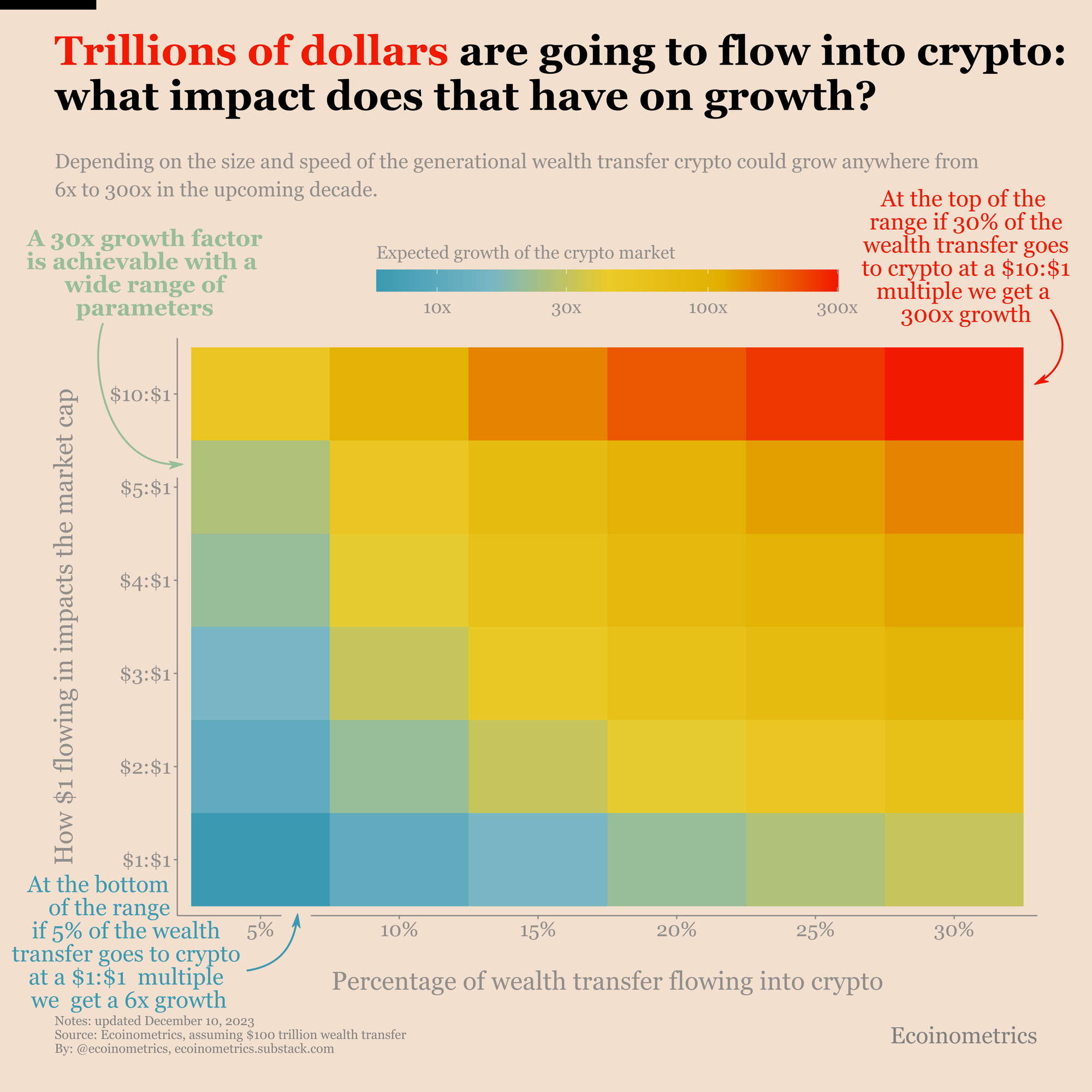

How is it going to impact Bitcoin and crypto? Hard to give exact numbers. But what we know for sure is that this wave of generational wealth transfer is coming to crash onto Bitcoin.

At a high level only two parameters matter:

- How much of this wealth transfer will accrue to Bitcoin (or crypto in general)?

- What is the impact of $1 of wealth transfer to the actual value of Bitcoin?

There is no way to know these numbers. But you can get an idea of the range of possibles:

- If only 10% of the wealth transfer accrue to Bitcoin with a $1 for $1 effect then Bitcoin would be worth 10x what it is now.

- If 20% of the wealth transfer accrue to Bitcoin with a $1 to $1 effect then Bitcoin would be worth 30x what it is now.

- If 20% of the wealth transfer accrue to Bitcoin with a $1 to $2 effect then Bitcoin would be worth 60x what it is now.

And the growth this will create on smaller crypto assets is bound to be much larger.

That is a lot of opportunities to turn a profit. If you have the knowledge to surf this wave properly.

The Bitcoin ETFs are making this possible

Now how is this wealth going to flow inside the Bitcoin market?

After all one of the main complaints people have regarding crypto is that the learning curve is steep. For the average investor there can be a lot of friction to buy and secure their first Bitcoin.

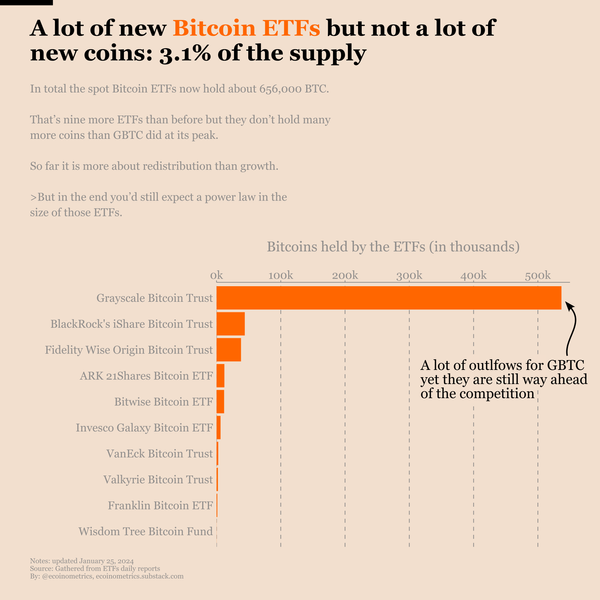

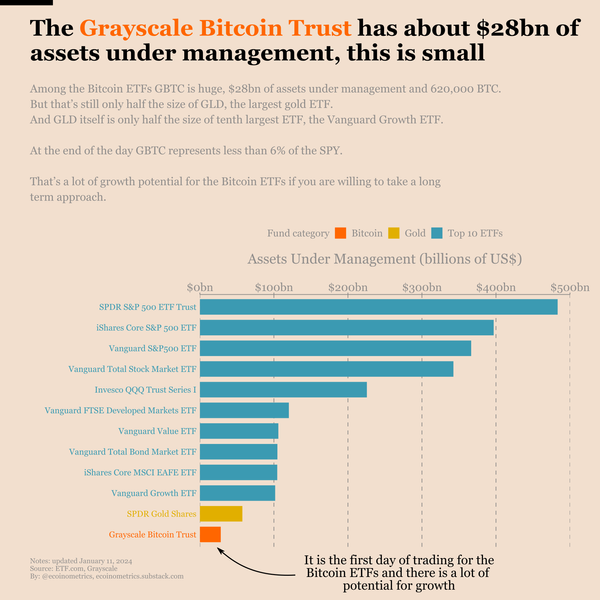

Enters the Bitcoin ETFs. Eleven of them have been approved by the SEC in January 2024. And they make Bitcoin accessible to pretty much everyone. If you can invest in the SPY now you can also invest in Bitcoin the exact same way. The frictions are gone.

In particular it allows the younger generations, Gen Xers, Millennials and Gen Z to allocate part of their retirement accounts to Bitcoin. That gives a clean mechanism for how the Baby Boomers wealth will slowly transfer to the younger generation and benefit Bitcoin.

How to surf the hundred trillion dollars wave?

As this unprecedented wealth transfer unfolds, the opportunity for savvy investors is clear. But are you equipped to navigate these potentially lucrative waters? With Ecoinometrics, you're not just observing the wave, you're riding it.

We offer cutting-edge, data-driven insights tailored for long-term investors like you. Our comprehensive reports, free from fluff and confusion, provide clarity in the complex world of crypto. We bring you industry-leading data visualizations that illuminate the path ahead, ensuring you're always a step ahead in the crypto journey.

Ecoinometrics is more than just a newsletter; it's a compass in the ever-shifting landscape of cryptocurrency. By subscribing, you're not just staying informed—you're gaining a decisive edge. With our deep dives into on-chain trends, macro liquidity influences, and in-depth coverage of critical market movements, you'll be equipped with the knowledge to make informed, confident investment decisions.

It's not just about understanding the present; it's about foreseeing the future. The crypto space, poised to potentially grow 50-fold, offers an unparalleled opportunity for growth. But it's a path laden with complexities and nuances.

Don't let this historic wealth transfer pass you by. Join Ecoinometrics today, and transform your investment strategy with unparalleled insights and foresight. Subscribe now to navigate the hundred trillion dollar wave with confidence and precision. Your journey towards informed, profitable crypto investing starts here.

Subscribe to Ecoinometrics and take the first step towards mastering the crypto market. Let's ride this wave together.

Ecoinometrics - For the investor who values knowledge, insight, and the power of data.

P.S. We spend our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick