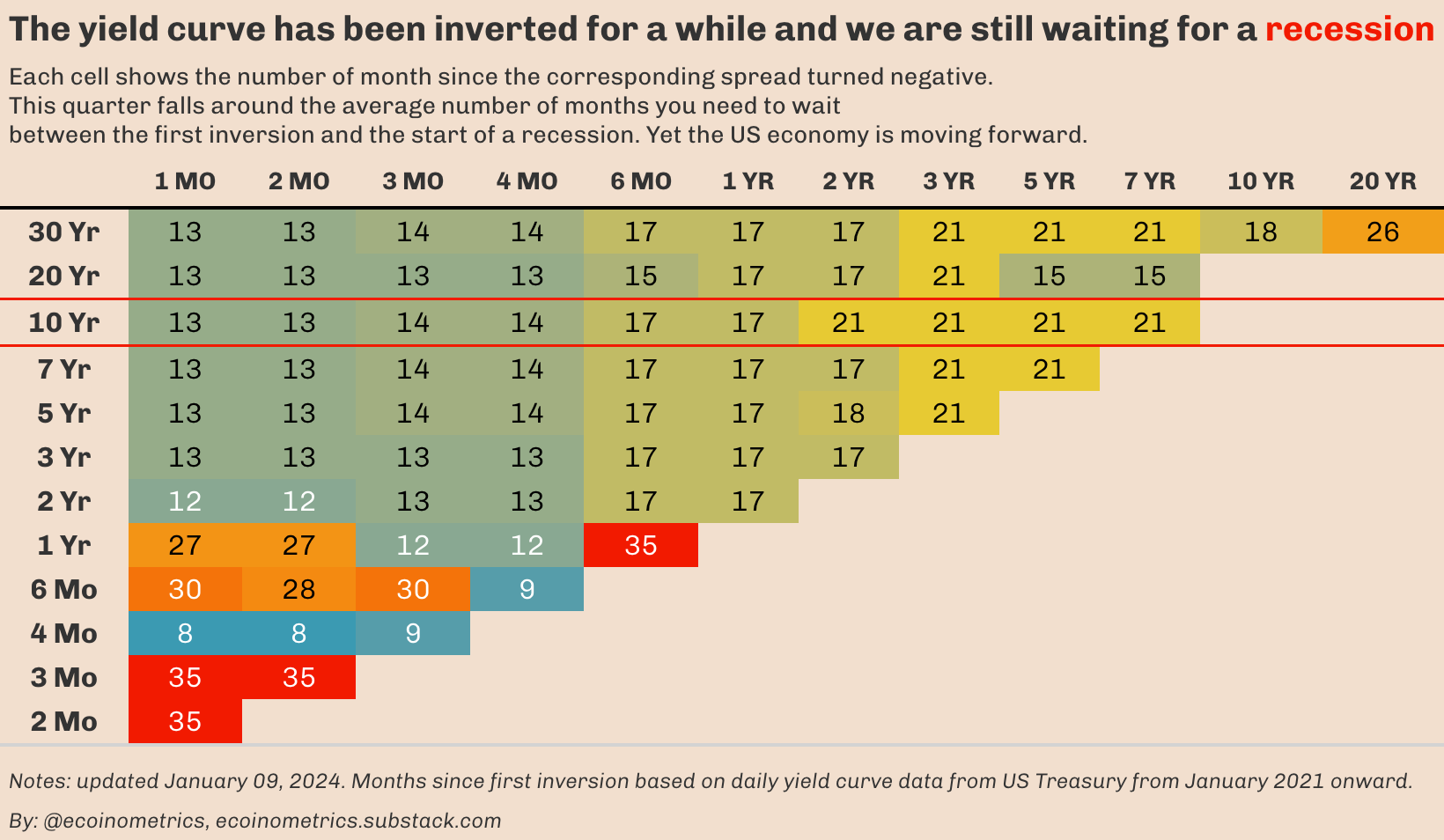

The yield curve has been inverted for more than a year: the risk of a recession is high in the US

Despite Wall Street's optimism, the prolonged inversion of the yield curve signals a looming recession risk in the US, challenging mainstream economic expectations.

No one is talking about the risk of recession anymore. The consensus on Wall Street is that the Federal Reserve is going to achieve a soft landing for the US economy.

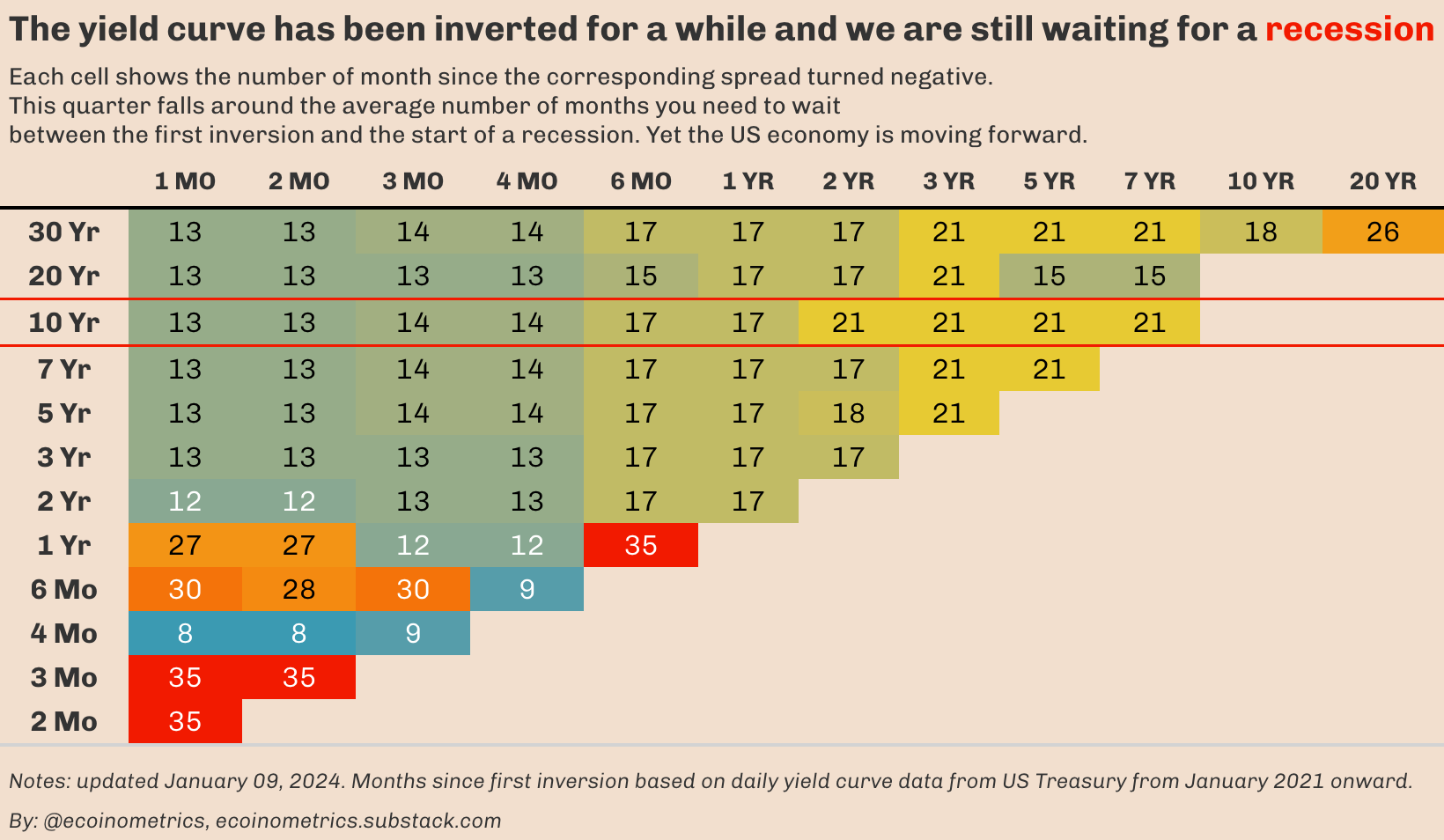

However the yield curve has been inverted for a long time. That’s true whatever spread you are looking at. If we focus on the spreads with the 10-year US Treasury yield we have:

- 13 months of inversion with the 1-month and the 2-month.

- 14 months of inversion with the 3-month and the 4-month.

- 17 months of inversion with the 6-month and the 1-year.

- 21 months of inversion with everything from 2-year to 7-year.

That is bad news because historically the inversion of the yield curve has been a harbinger of recessions, with a 100% track record over a 100 years.

So is this one an outlier? Is the bond market wrong? Is there something fundamentally different in the US economy today?

I don't have answers to those questions. But I sure do know that "this time is different" are four dangerous words, especially for investors.

The yield curve might very well become un-inverted in 2024 if the Federal Reserve is doing aggressive rate cuts like Wall Street expects.

But that’s no guarantee that the US will avoid a recession.