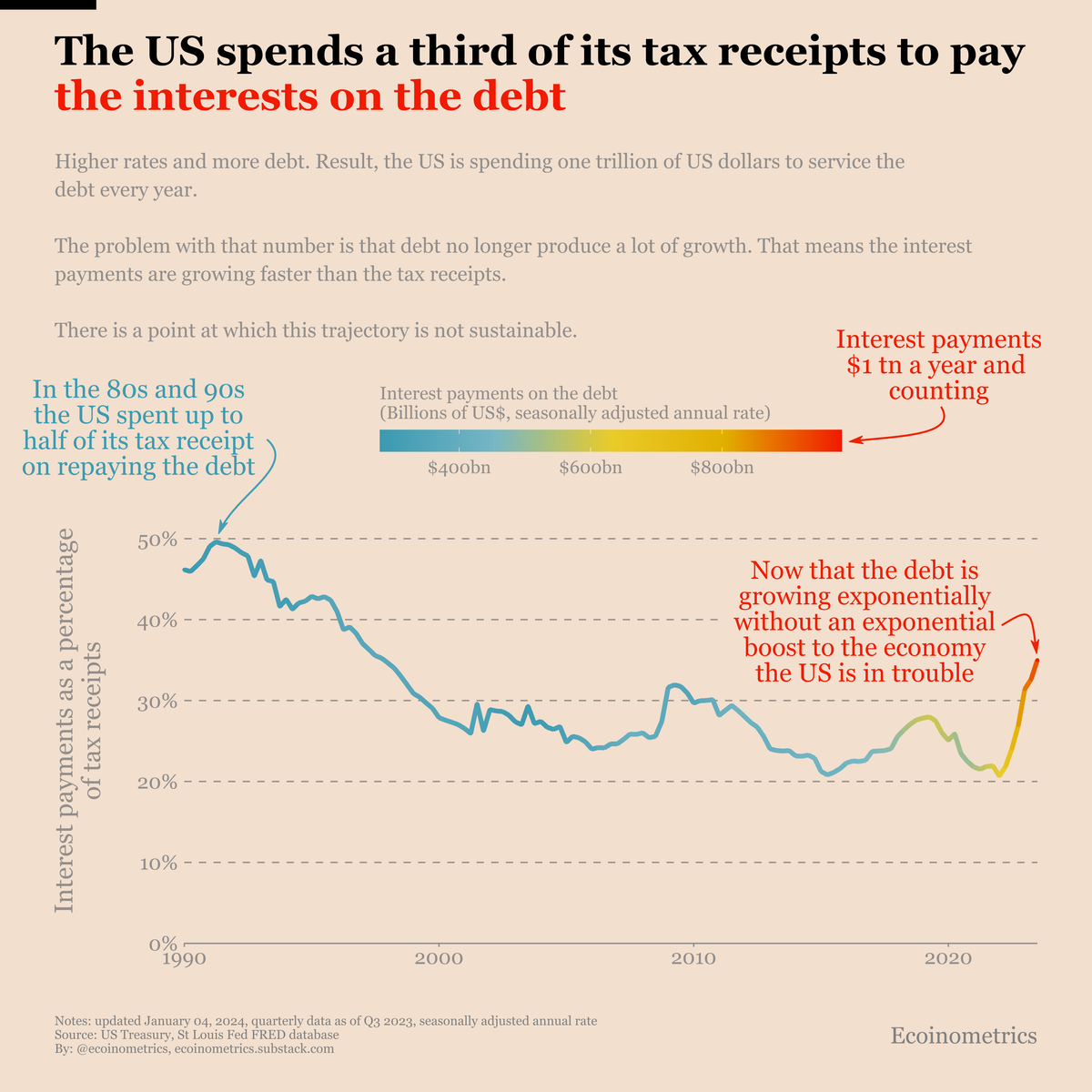

The US spends a third of its tax revenues to pay the interests on the debt

US teeters on a fiscal precipice, with a third of tax receipts swallowed by debt interest, mirroring a precarious past and an uncertain future.

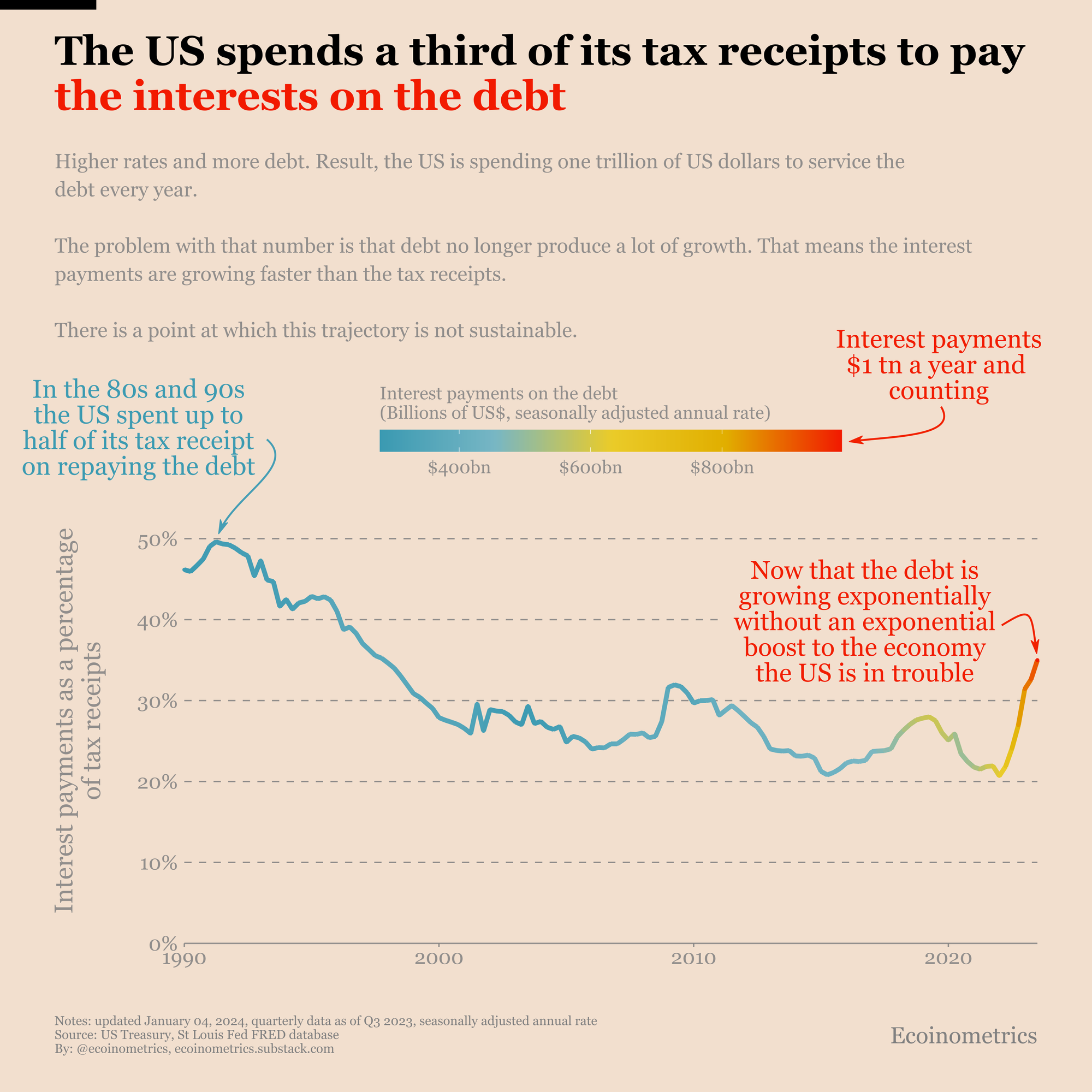

The US spends a third of its tax receipts on paying the interest on the debt. That’s the state of things as of the third quarter in 2023.

But what’s worrying is the trajectory of the interest payments relative to the tax receipts. More debt is being issued by the US at higher interest rates. But we have reached a point where more debt no longer means faster growth.

That’s the problem here. Because at the end of the day the US has more debt with less tax receipts.

The US is on a trajectory to return to the situation of the mid 1980s to early 1990s. Back then half of the tax receipts were spent on paying the interest on the debt.

How did the US managed to get out of this situation? The 90s brought a combination of:

- A cut in military spending.

- A rise in taxes.

- A decade long economic boom.

I don’t think we can expect anything similar in the next 10 years. The US has no incentive to lower military spendings given the geopolitic situation. There is no consensus in the senate to raise taxes. And (unless AI completely changes the game) we don’t have any clear driver of economic growth in sight.

So chances are the next decade is uncharted territory.

I bet that the growing burden of interest payments on US debt will significantly influence the Federal Reserve's monetary policy in the coming decade.

The chances of returning to fiscal dominance are real.

P.S. We our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick