On the first day of trading for the new Bitcoin ETFs, the potential for growth is huge

On the first day of trading for the new Bitcoin ETFs the potential for growth is huge.

It took years of work but the SEC finally approved a first batch of Bitcoin ETFs in the US.

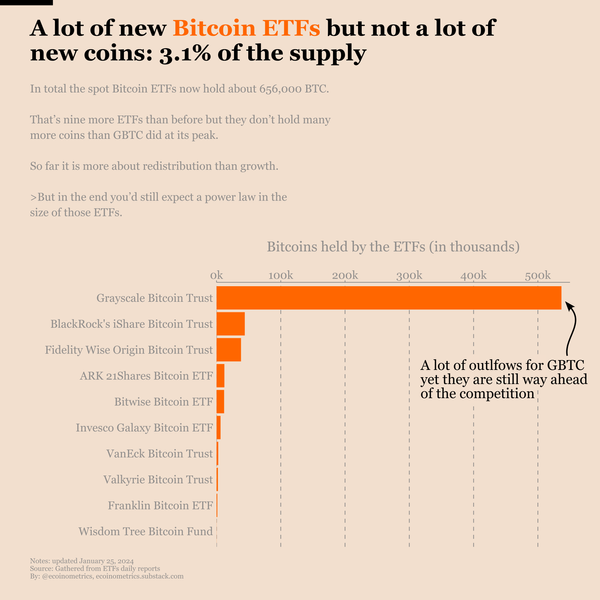

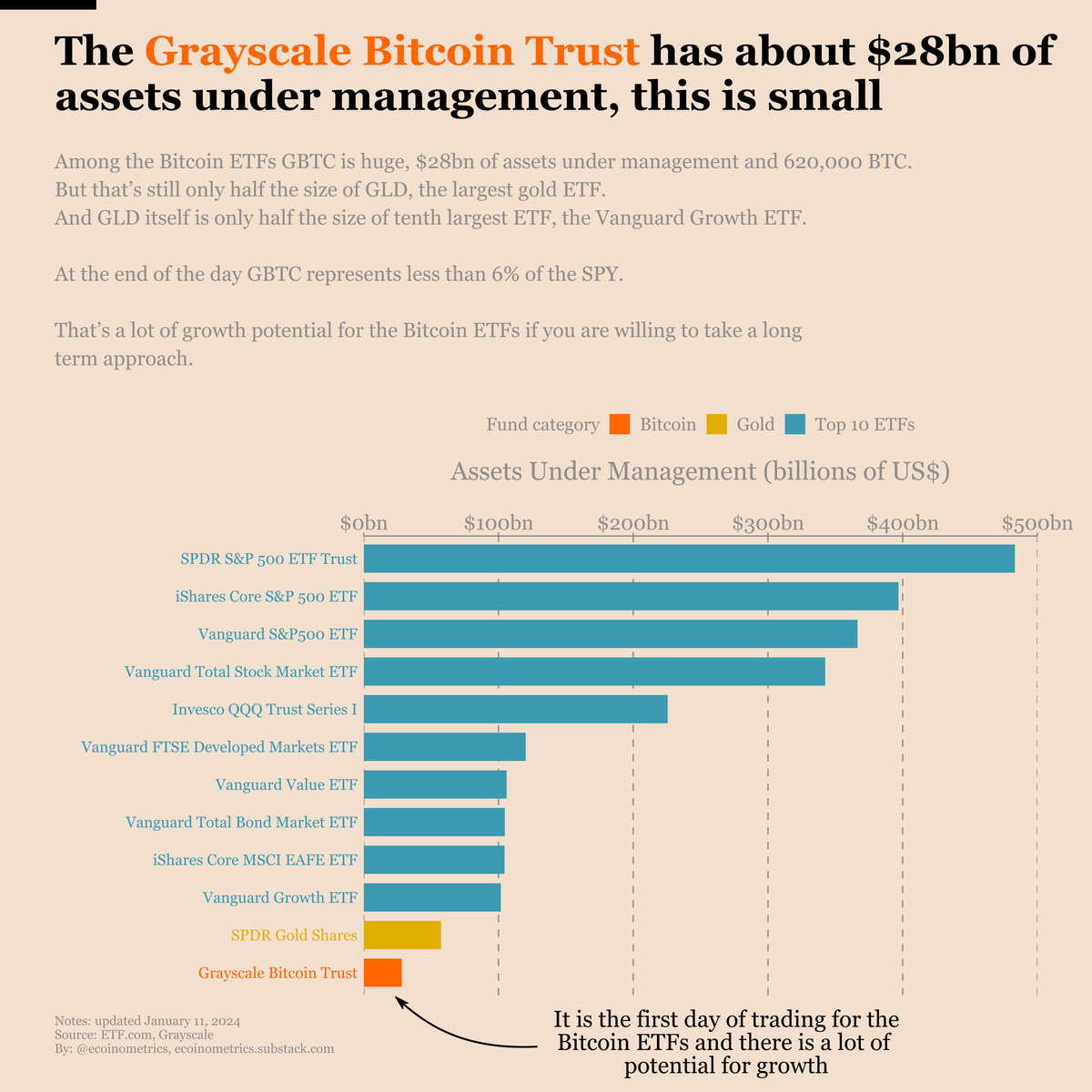

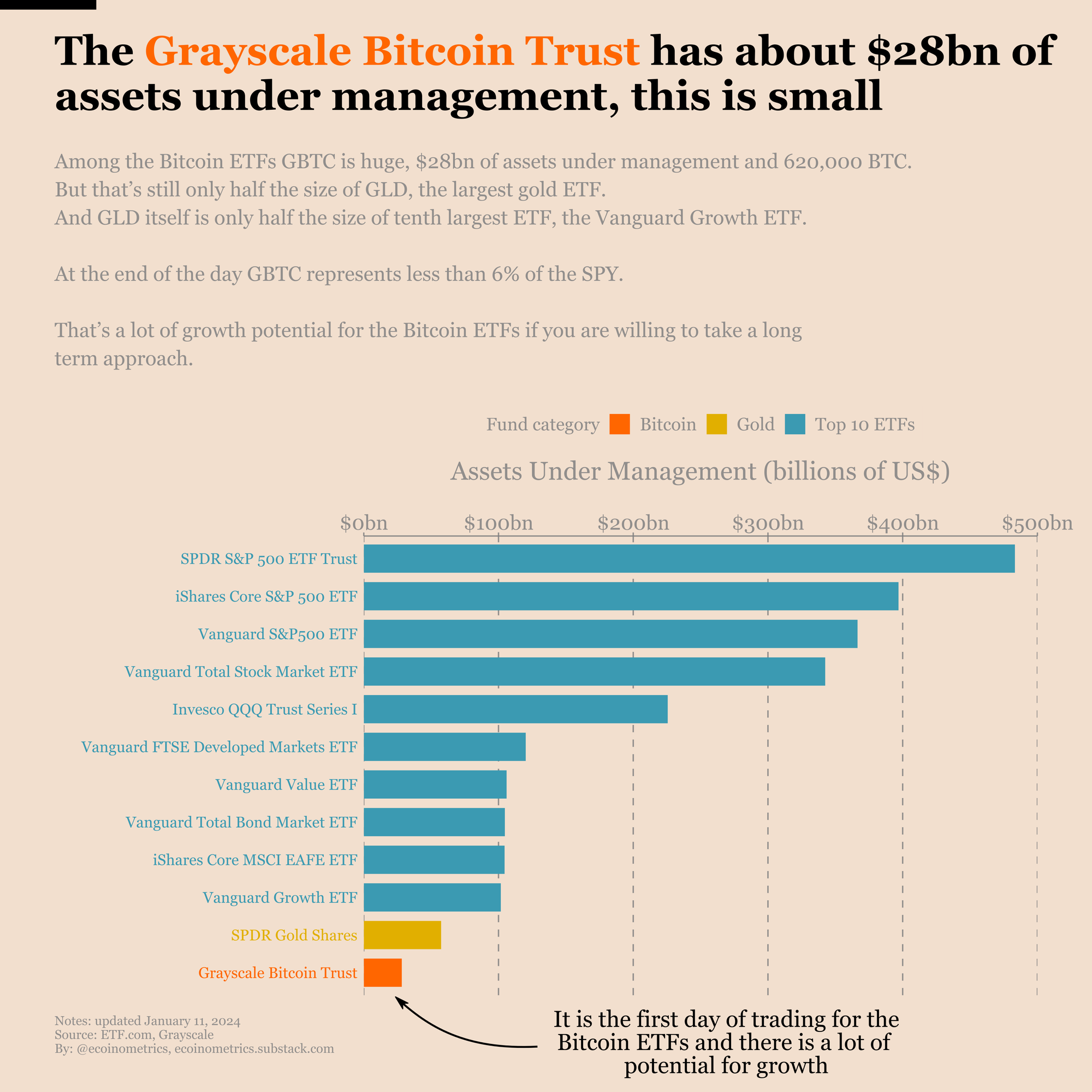

Trading starts today for many of those and the growth potential is massive. To give you a sense of scale, the Grayscale Bitcoin Trust (GBTC) is currently the largest Bitcoin ETF with $28 billion of assets under management (holding 620,000 Bitcoins).

But that’s only half of the size of the largest gold ETF: GLD has $56 billion of assets under management. And the largest gold ETF is also only half the size of the tenth largest ETF, the Vanguard Growth ETF.

At the end of the day , GBTC represents less than 6% of the SPY which is the largest ETF overall with about $500 billion of assets under management.

That’s a lot of growth potential for the Bitcoin ETFs if you are willing to take a long term view. Those ETFs are unlocking access to Bitcoin for a whole new pool of investors.

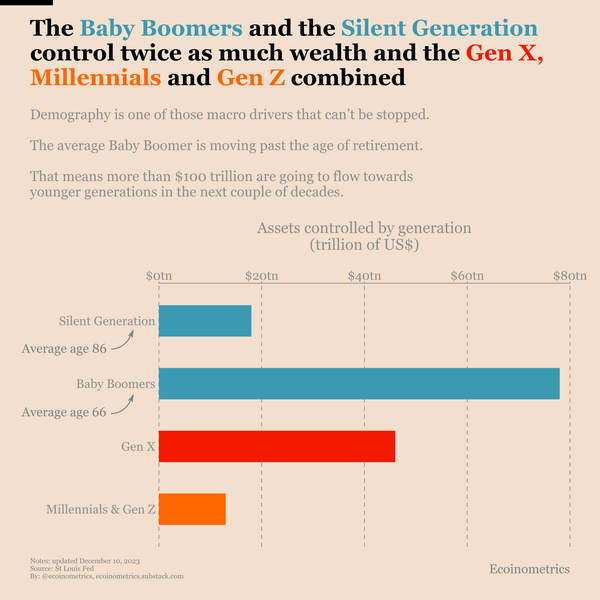

Among those are retirement accounts which for demographic reasons are likely to create inflows into the Bitcoin market for decades (for more on that idea checkout our research note over here).

This is a key element to enable the $100 trillion wave that will carry Bitcoin over the next decade.

But however you look at it, this is good for Bitcoin.

P.S. We our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick