How many rate cuts in 2024: three according to the Federal Reserve, six according to Wall Street

The US Federal Reserve cautiously eyes rate cuts amidst divergent Wall Street expectations and persistent inflation concerns.

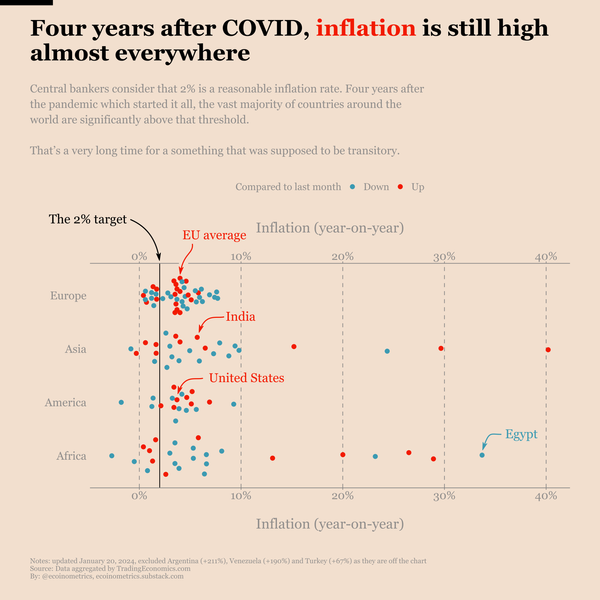

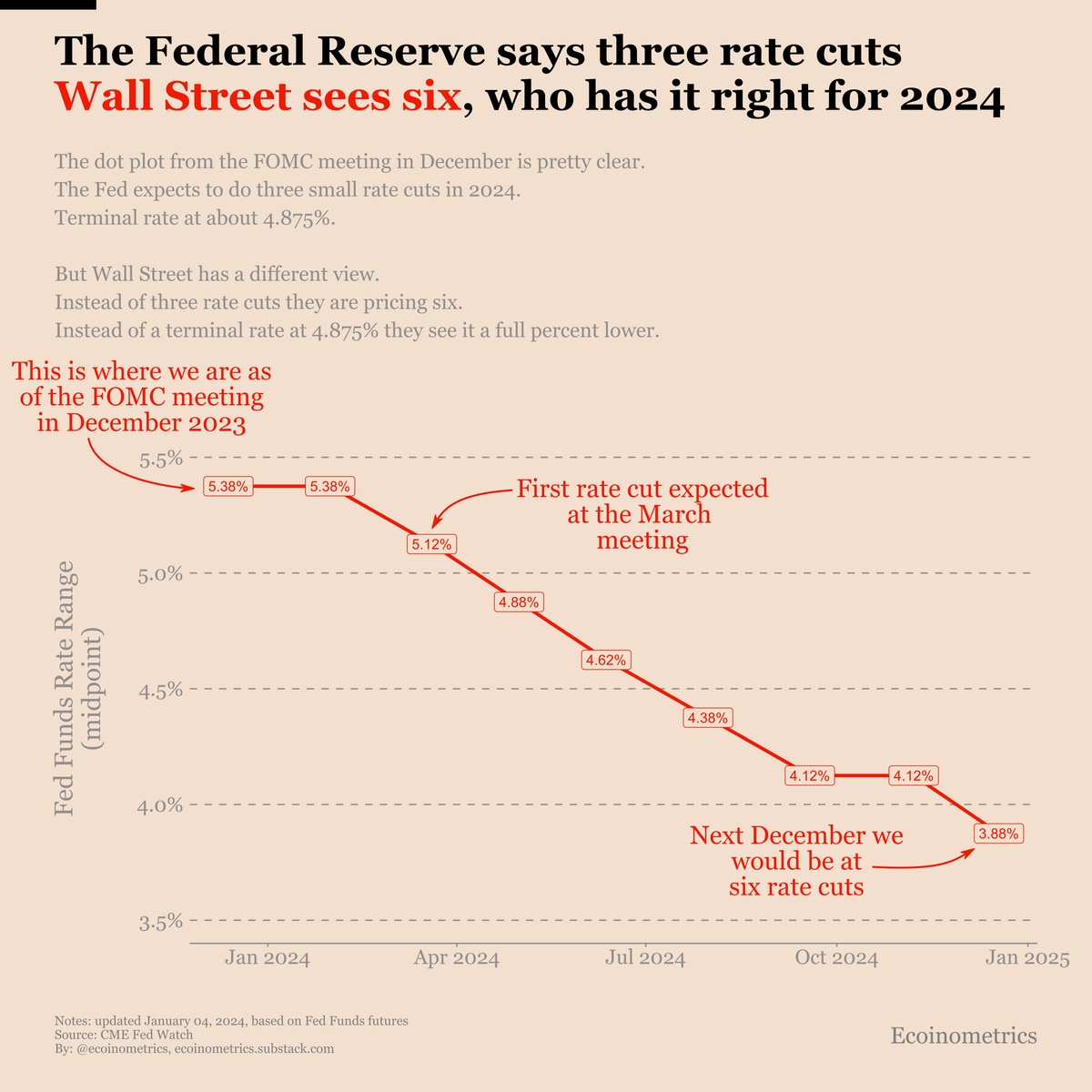

Inflation isn't really under control in the US. But it has made enough progress on the path going back to the 2% level that the Federal Reserve is feeling ok with the idea of cutting rates.

At least that's what the dot plot from the projection materials of the latest FOMC meeting in December 2023.

Based on the dot plot the FOMC expects to:

- Cut maybe three times in 2024.

- Bring down the Fed Funds rate to 4.875%.

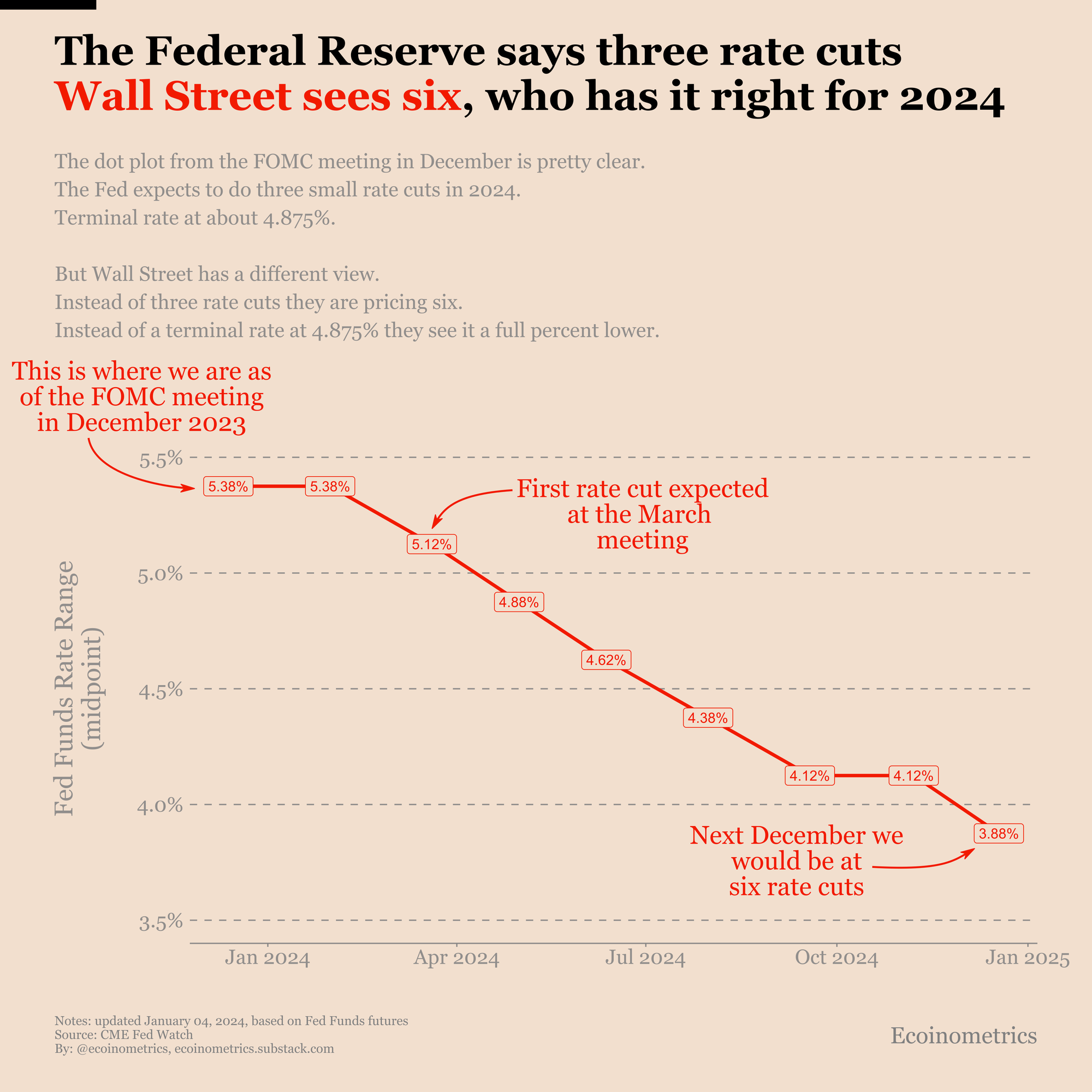

Meanwhile Wall Street through the Fed Funds rate futures signals they expect six rate cuts bringing down the Fed Funds rate to 3.875%.

You can see the expected path for the Fed Funds rate based on those future contracts on the chart below.

The first rate cute would happen as early as March. Then almost every subsequent FOMC meeting would result in another cut.

So there is a massive discrepancy between the consensus on Wall Street and the consensus at the Federal Reserve.

My take is that it is unlikely the Federal Reserve will cut rate aggressively in 2024. Inflation is still too sticky and the financial conditions are still too loose for that to make sense.

The only reason the FOMC would cut rates aggressively is if the US enters a recession. But we are not there yet.

P.S. We our days, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below and subscribe to the Ecoinometrics newsletter ✉️ ⤵️

Cheers,

Nick